japan corporate tax rate 2022

Puerto Rico follows at 375 and. Capital gains tax CGT rates Headline corporate capital gains tax rate Capital gains are subject to the normal CIT rate.

2022 Tax Reform Passage Of The Bills Kpmg Japan

Exports and certain services to non-residents are taxed at a zero rate.

. Dividend taxation on capital surplus was imposed by deeming the amount calculated as follows as the amount of deemed dividend X under Article 23 Paragraph 1 Item 1 of the Corporate Tax Act. But countries can mitigate those harms with lower corporate tax rates and generous capital allowances. And b approximately 35 with a certain favourable rate for up to the first eight.

Consumption tax value-added tax or VAT is levied when a business enterprise transfers goods provides services or imports goods into Japan. For any domestic corporation registered in Japan both for domestic and subsidiaries of foreign companies a corporate tax on national level is levied by the National Tax Agency an integral part of the Ministry of Finance. Income Tax Rates and Thresholds Annual Tax Rate.

An under-payment penalty is imposed at 10 to 15 of additional tax due. Specified transactions such as sales. The applicable rate is 8.

Amount of capital etc corresponding to the amount of refunded capital immediately before. Headline individual capital gains tax rate Gains arising from sale of stock are taxed at a total rate of 20315 15315 for national tax purposes and 5 local tax. Corporate Taxation in Japan.

Combined Statutory Corporate Income Tax Rate. Comoros has the highest corporate tax rate globally of 50. Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022.

Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. The rate is increased to 10 to 15 once the tax audit notice is received. Social Security Rate 3152.

The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is. Sales Tax Rate 1000. 7 rows Japan Income Tax Tables in 2022.

Corporate Tax Rate 3062. The Outline proposes that if the total compensation paid to specified employees 2 in the current year beginning between 1 April 2022 and 31 March 2024 increases by 3 or more as compared to total compensation paid to specified employees in the previous year the excess of the current years compensation over the previous years compensation is eligible for a 15. Corporate Tax Rates.

A approximately 31 for large companies ie companies with a stated capital of more than 100 million yen. AC PQ if PQ or 1 if PQ SAR. The corporate income tax is a tax on the profits of corporations.

Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021. In the case that a corporation amends a tax return and tax liabilities voluntarily. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies.

Personal Income Tax Rate 5597. The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy. It depends on companys scale location amount of taxable income rates of tax and the other.

Corporate Tax Rate. Local management is not required. All OECD countries levy a tax on corporate profits but the rates and bases vary widely from country to country.

As of 1 October 2019 the rate increased to 10. The present corporate taxation level will vary from 15 up to 232 on the annual net business income of the company.

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

2022 Corporate Tax Rates In Europe Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Australia Tax Income Taxes In Australia Tax Foundation

Corporation Tax Europe 2021 Statista

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

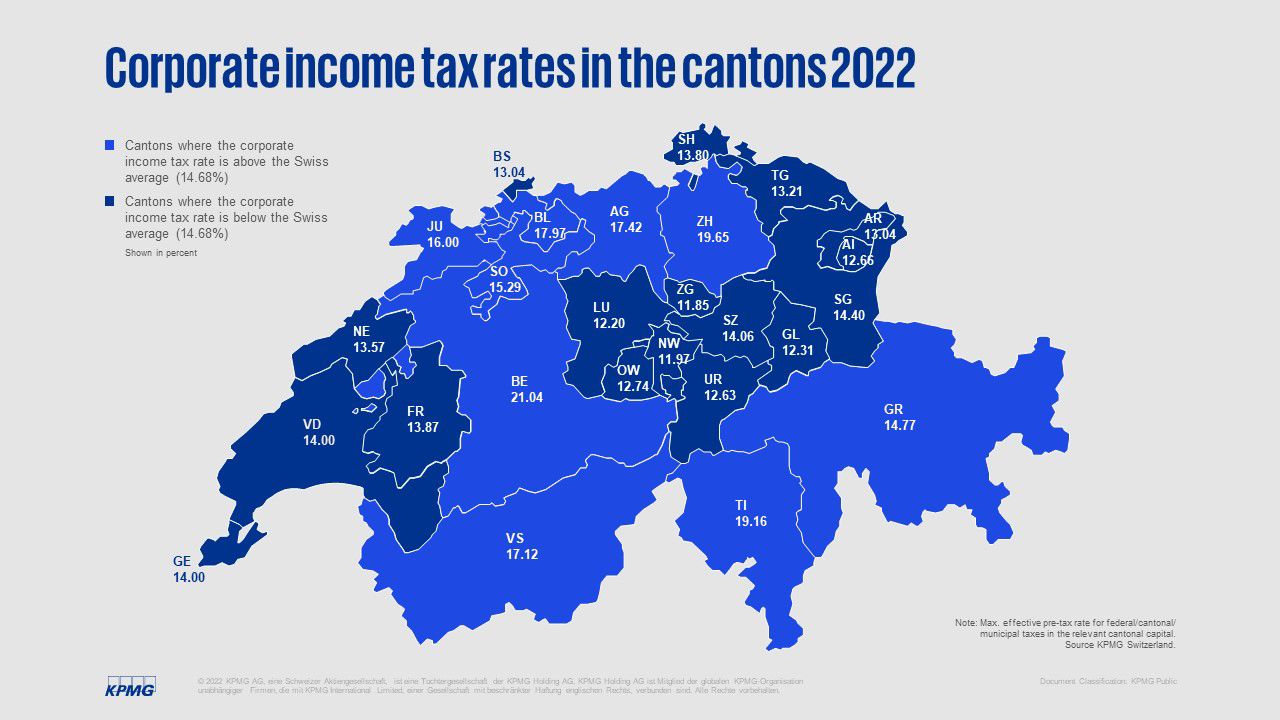

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

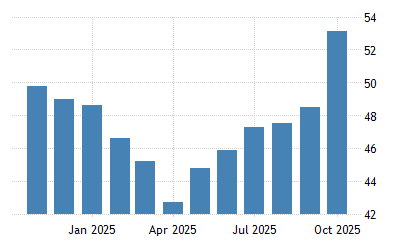

Japan Exports Yoy July 2022 Data 1964 2021 Historical August Forecast Calendar

Australia Tax Income Taxes In Australia Tax Foundation

Kishida Retreats From New Capitalism East Asia Forum

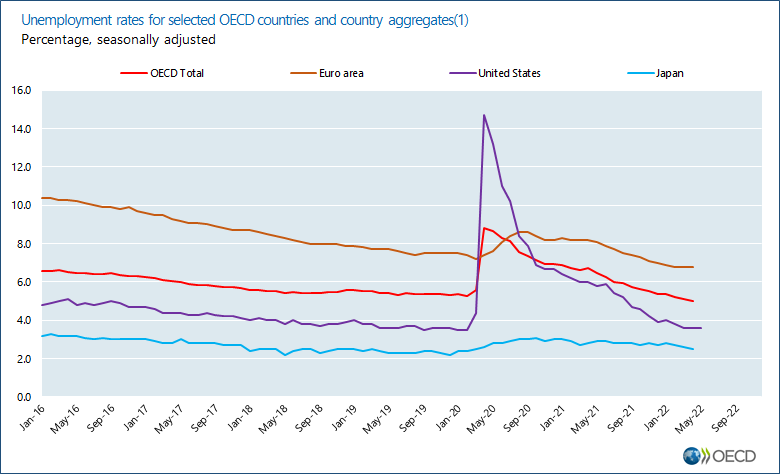

Unemployment Rates Oecd Updated June 2022 Oecd

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Japanese Consumption Tax Invoicing The Tax Qualified Invoice System